How it’s Used Wind Energy System

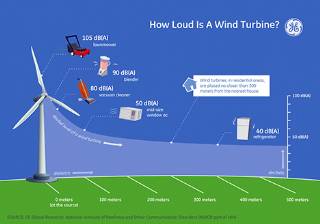

A “wind energy conversion system” is defined as any device, such as a wind charger, windmill, or wind turbine, which converts wind energy to a form of usable energy. Wind energy conversion systems can also include an entire wind energy “farm” made of multiple turbines.

Minnesota is in the top 10 in the nation for both installed wind capacity and net electricity produced from wind. Over one-seventh of the state’s net production came from wind power in 2012 (Retrieved from eia.gov).

Current taxation process

Wind Energy Conversion Systems (WECS) are exempt from ad valorem property taxes, but are subject to a wind energy production tax. (See Minnesota Statutes 272.029.) This production tax was enacted in 2002.

The following wind energy conversion systems are exempt from tax:

- Small scale systems with a capacity of 0.25 megawatts or less

- Small scale systems owned by a municipality and with a capacity of 2 megawatts or less

There is no process of valuation, allocation, or apportionment as with other energy producing facilities.

By February 1 of each year, the owner of the wind energy conversion system must file a form with the commissioner of revenue detailing the amount of electricity produced in the previous calendar year. If a wind energy company fails to file a report by the due date, the department will determine the tax due based on the “nameplate capacity” of the system multiplied by 60 percent. The nameplate capacity is the maximum output rating of a wind generator.

Revenue annually calculates the amount of wind energy production tax due and notifies the system owners and County Auditors. The tax is paid to the County Treasurer and then distributed – 80 percent to counties and 20 percent to cities and townships.

Current tax rates for Wind Energy Production Tax (WEPT)

The rates for the wind energy production tax are legislatively set and are based on the energy output of the conversion system.

Distribution of WEPT revenues

The tax is distributed, along with the regular property tax settlements made by the county treasurer, to the local governments in the following percentages for 2010 distributions and thereafter: 80 percent to counties and 20 percent to cities and townships. The state does not receive WEPT revenues.

Exclusions and exemptions

JOBZ

Wind energy conversion systems qualifying as JOBZ properties do not pay wind energy production tax for the duration of the zone. This exemption is not limited to qualified businesses and is granted to any wind energy conversion systems that become included within a JOBZ.

Assessors or auditors granting these exemptions are asked to notify Revenue of their existence to ensure they are tracked for when the exemptions expire. As of this report, no one has notified the department of the existence of conversion systems in qualifying JOBZ.

ayment in lieu of WEPT

A developer of a new or existing wind energy conversion system may negotiate with the county where the wind energy conversion system is located to establish a payment instead (“in lieu”) of the wind energy production tax.

The in lieu payment provides fees or compensation to the host jurisdictions to maintain public infrastructure and services. A host jurisdiction includes a city or town and the county where the facility is located. The payment in lieu of the production tax may be based on production capacity, historical production, or other factors agreed upon by the parties.

The payment in lieu of tax agreement must be signed by the parties and filed with the commissioner of revenue and the County Recorder. Exemption from the production tax is effective for the same duration as the in lieu payments.

As of this report, no owners of wind energy conversion systems have filed an agreement with Revenue.

Variation in taxes

The different tier structures complicate the tax system and make it difficult to make generalizations about tax amounts. For example, a large power company may split off ownership of various conversion systems. This way they are considered (separately) as small-scale systems and assessed a lower tax rate, even if the company as a whole would be considered a large-scale system. Disputes related to the size of the system are settled by the Department of Commerce.

Costs and benefits

Benefits to communities for hosting a wind energy producing facility are similar to other renewable energy sources. These benefits include a stronger tax base, lower taxes, and other economic benefits.

In general, renewable energy sources have very small external costs in comparison to fossil fuels. Lifecycle emissions from wind power are extremely low. Costs to the community may include impacts on wildlife and the area’s landscape (National Research Council, 2009).

Labels

How it’s Used Wind Energy Systemrenewable energy certificatesphotovoltaic solar energywind energy powerwind panelswind energy useswind poweralternative energywind turbine bladeshouse wind turbine priceshome wind power generatorscost of small wind turbinesmallest wind generatorFarming Principle: Deep Soil Preparation

Looking at GB as a three-legged stool, deep soil preparation is one of the legs. Deep soil preparation builds soil and soil structure by loosening the soil to a depth of 24 inches (60 cm). Ideal soil structure has both pore space for air and water to move freely and soil particles that hold together nicely.

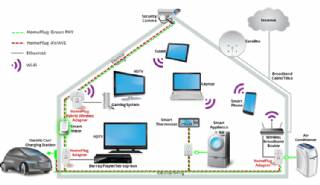

Smart Home Ecosystem - Smart Home Automation - Smart Home Security - Smart Home Technology

The outer-most level corresponds to the individual devices and sensors that consumers interact with. Several candidates are vying for the role of a leader introducing smart home services to the mass market.

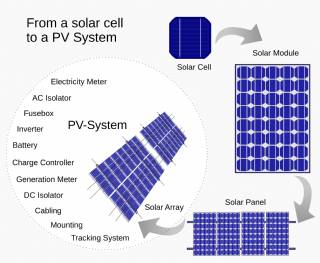

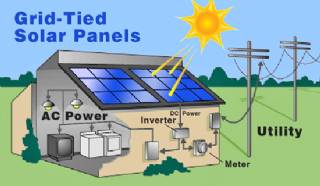

Solar Energy Systems - Solar Modules - Solar Electric System Design - Solar Power

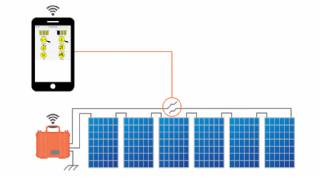

The heart of a photovoltaic system is the solar module. Many photovoltaic cells are wired together by the manufacturer to produce a solar module. When installed at a site, solar modules are wired together in series to form strings. Strings of modules are connected in parallel to form an array.

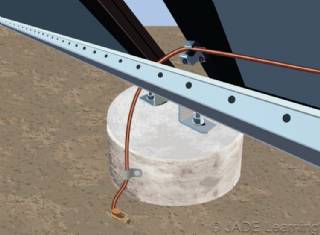

Solar Energy Systems - Array Mounting Racks - Solar Ray - Solar Panel - PV Racks and Mounts

Arrays are most commonly mounted on roofs or on steel poles set in concrete. In certain applications, they may be mounted at ground level or on building walls. Solar modules can also be mounted to serve as part or all of a shade structure such as a patio cover. On roof-mounted systems, the PV array is typically mounted on fixed racks, parallel to t

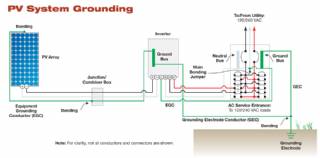

Solar Energy Systems - Grounding Equipment

Grounding equipment provides a well-defined, low-resistance path from your system to the ground to protect your system from current surges from lightning strikes or equipment malfunctions. Grounding also stabilizes voltages and provides a common reference point. The grounding harness is usually located on the roof.

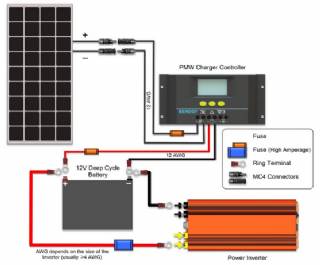

Solar Energy Systems - Solar Inverter - Solar Panel Inverter

Most grid-connected inverters can be installed outdoors, while most off-grid inverters are not weatherproof. There are essentially two types of grid-interactive inverters: those designed for use with batteries and those designed for a system without batteries.

Solar Energy Systems - Solar Disconnects

Automatic and manual safety disconnects protect the wiring and components from power surges and other equipment malfunctions. They also ensure the system can be safely shut down and system components can be removed for maintenance and repair.

Solar Energy Systems - Solar Battery Bank

Batteries store direct current electrical energy for later use. This energy storage comes at a cost, however, since batteries reduce the efficiency and output of the PV system, typically by about 10 percent for lead-acid batteries. Batteries also increase the complexity and cost of the system.

Solar Energy Systems - Solar Charge Controller

A charge controller, sometimes referred to as a photovoltaic controller or battery charger, is only necessary in systems with battery back-up. The primary function of a charge controller is to prevent overcharging of the batteries. Most also include a lowvoltage disconnect that prevents over-discharging batteries. In addition, charge controllers pr

Solar Energy Systems - The NEC and PV Systems

Solar PV systems must be installed in accordance with Article 690 of the National Electric Code, which specifically deals with PV systems, as well as several other articles of the NEC that pertain to electrical systems in general. When there is a conflict between NEC 690 and any other article, NEC 690 takes precedence due to the unique nature of PV